Chipotle’s Business Model and Performance

Chipotle Mexican Grill, Inc. (CMG) is a leading fast-casual restaurant chain known for its customizable menu of burritos, bowls, salads, and tacos. The company has built a strong brand identity based on its commitment to fresh, high-quality ingredients and its focus on sustainability. This has enabled Chipotle to attract a loyal customer base and achieve consistent growth over the years. However, the company has also faced challenges, including food safety incidents and rising labor costs, which have impacted its financial performance. This analysis delves into the key aspects of Chipotle’s business model, its performance, and its competitive landscape.

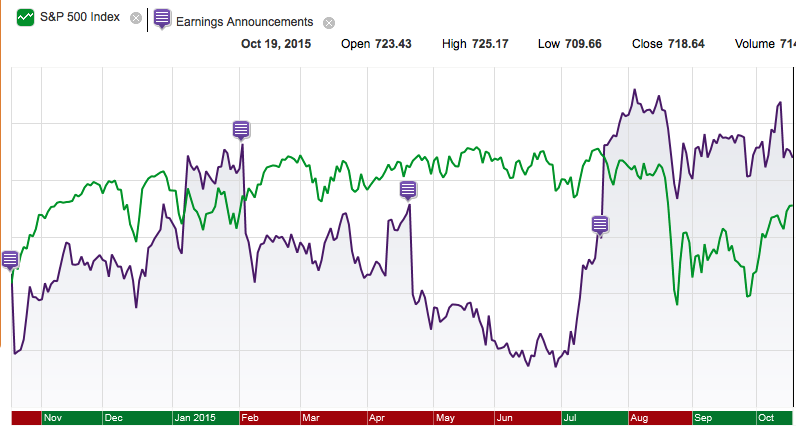

Chipotle’s Business Model: Strengths and Weaknesses, Chipotle stock

Chipotle’s business model centers around offering a limited menu of customizable food items made with fresh ingredients. This approach allows for operational efficiency and a focus on quality control. The company’s commitment to using local and sustainable ingredients also resonates with environmentally conscious consumers. However, Chipotle’s business model also presents certain weaknesses. The company’s reliance on fresh ingredients can lead to higher food costs and potential supply chain disruptions. Additionally, the labor-intensive nature of its operations can contribute to higher labor costs, especially in tight labor markets.

Factors Contributing to Chipotle’s Recent Financial Performance

Chipotle’s recent financial performance has been influenced by several factors. The company’s focus on digital ordering and delivery has helped to drive sales during the COVID-19 pandemic and beyond. Chipotle has also implemented various cost-saving measures, such as menu price increases and operational efficiencies, to mitigate the impact of rising inflation. Additionally, the company’s expansion into new markets and its focus on innovation, such as its new “Chipotle Rewards” loyalty program, have contributed to its growth.

Comparison with Major Competitors

Chipotle competes with other fast-casual restaurant chains, including Panera Bread, Subway, and Qdoba. While these competitors offer similar menu items and price points, Chipotle differentiates itself through its focus on fresh, high-quality ingredients and its commitment to sustainability. The company’s strong brand identity and loyal customer base have allowed it to maintain a premium pricing strategy compared to its competitors.

Revenue Streams and Cost Structure

Chipotle’s primary revenue stream is derived from the sale of its food items. The company also generates revenue from merchandise sales and licensing agreements. Chipotle’s cost structure is dominated by food costs, labor costs, and occupancy costs. The company’s reliance on fresh ingredients contributes to its higher food costs compared to competitors that use frozen or processed ingredients.

Expansion Strategy and Potential Impact on Future Growth

Chipotle has been expanding its footprint both domestically and internationally. The company has opened new restaurants in existing markets and has also entered new markets, such as Canada and Europe. This expansion strategy is expected to drive future growth, but it also presents challenges, such as navigating local regulations and consumer preferences.

Chipotle’s Industry Landscape and Competitive Analysis: Chipotle Stock

Chipotle Mexican Grill operates within the highly competitive fast-casual restaurant industry, characterized by its focus on fresh, high-quality ingredients and a streamlined dining experience. The industry is dynamic, driven by evolving consumer preferences, technological advancements, and economic factors. Understanding the industry landscape and Chipotle’s competitive positioning is crucial to assessing its future prospects.

Key Trends Shaping the Fast-Casual Restaurant Industry

The fast-casual restaurant industry is experiencing several significant trends:

- Growing Demand for Healthier Options: Consumers are increasingly prioritizing healthier food choices, driving demand for restaurants that offer fresh, wholesome ingredients and customizable options. Chipotle’s focus on fresh, minimally processed ingredients aligns with this trend.

- Convenience and Speed: The fast-paced nature of modern life fuels the demand for convenient and quick dining options. Fast-casual restaurants cater to this need by offering efficient service and a streamlined dining experience. Chipotle’s assembly line-style ordering and quick preparation times are well-suited to this trend.

- Technology and Digital Ordering: The rise of online ordering and mobile payments is transforming the restaurant industry. Fast-casual restaurants are embracing these technologies to enhance customer convenience and streamline operations. Chipotle has invested heavily in its digital ordering platforms, allowing customers to place orders online, through its app, or via third-party delivery services.

- Sustainability and Ethical Sourcing: Consumers are increasingly conscious of the environmental and social impact of their food choices. Fast-casual restaurants are responding by emphasizing sustainable practices and ethical sourcing. Chipotle’s commitment to using responsibly sourced ingredients and reducing its environmental footprint resonates with this trend.

Competitive Landscape

Chipotle faces competition from a range of players within the fast-casual restaurant industry. Some of its major rivals include:

- Qdoba Mexican Eats: Qdoba offers a similar menu to Chipotle, featuring customizable burritos, bowls, and tacos. It has a slightly broader menu, including items like quesadillas and nachos. Qdoba is known for its more adventurous flavors and its use of more traditional Mexican ingredients.

- Moe’s Southwest Grill: Moe’s is another fast-casual Mexican restaurant chain that competes directly with Chipotle. It offers a similar menu, but with a slightly different focus on Southwest flavors and ingredients. Moe’s is known for its “Home-Style” atmosphere and its emphasis on customer service.

- Panera Bread: Panera Bread is a fast-casual bakery-cafe chain that offers a wide range of menu items, including sandwiches, salads, soups, and baked goods. Panera has positioned itself as a healthier alternative to traditional fast food, emphasizing fresh ingredients and customizable options. Panera’s focus on healthy eating and its strong brand recognition make it a significant competitor for Chipotle.

- Subway: Subway is a global fast-food chain that specializes in customizable sandwiches. It is a major player in the fast-casual space, known for its wide range of toppings and its affordability. Subway’s focus on customization and its extensive global presence make it a strong competitor for Chipotle.

Comparison and Contrast of Offerings

Chipotle’s offerings and positioning differ from its competitors in several ways:

- Focus on Fresh, Whole Ingredients: Chipotle distinguishes itself by its commitment to using fresh, minimally processed ingredients. It avoids using artificial flavors, colors, and preservatives, appealing to consumers seeking healthier food options.

- Limited Menu: Chipotle offers a limited menu, focusing on a few core items like burritos, bowls, tacos, and salads. This allows the company to focus on perfecting its core offerings and ensuring the freshness and quality of its ingredients.

- Customization: Chipotle’s assembly line-style ordering process allows customers to customize their meals with a wide range of toppings and sauces. This provides a personalized dining experience and caters to individual dietary preferences.

- Emphasis on Sustainability: Chipotle is committed to sustainable practices, including using responsibly sourced ingredients and reducing its environmental footprint. This commitment aligns with consumer values and differentiates the company from its competitors.

Impact of External Factors

Chipotle’s business is impacted by several external factors:

- Consumer Preferences: Consumer preferences for food are constantly evolving, influenced by factors like health consciousness, dietary restrictions, and cultural trends. Chipotle must adapt its offerings and marketing strategies to stay ahead of these changing preferences.

- Economic Conditions: Economic conditions can impact consumer spending and demand for restaurant meals. During economic downturns, consumers may cut back on discretionary spending, including dining out. Chipotle must navigate these fluctuations by offering value-oriented options and adjusting its pricing strategies.

- Technological Advancements: Technological advancements, such as online ordering, mobile payments, and delivery services, are transforming the restaurant industry. Chipotle must invest in these technologies to enhance customer convenience and streamline operations.

Opportunities and Threats

Chipotle faces both opportunities and threats within the fast-casual restaurant industry:

- Opportunities:

- Expanding into New Markets: Chipotle has significant growth potential by expanding into new domestic and international markets.

- Innovation in Menu Offerings: Chipotle can continue to innovate its menu by introducing new items and flavor combinations to cater to evolving consumer preferences.

- Strengthening its Digital Presence: Chipotle can further enhance its digital capabilities by investing in its online ordering platform, mobile app, and delivery services.

- Threats:

- Increased Competition: The fast-casual restaurant industry is highly competitive, with new players emerging and established chains expanding their presence.

- Rising Food Costs: Fluctuations in commodity prices can impact Chipotle’s costs and profitability. The company must find ways to mitigate these risks, such as sourcing ingredients more efficiently.

- Negative Publicity: Chipotle has faced negative publicity in the past due to food safety concerns. Maintaining a strong food safety record is crucial to protecting its reputation and brand image.

Chipotle’s Financial Analysis and Valuation

Chipotle Mexican Grill, Inc. (CMG) is a popular fast-casual restaurant chain known for its customizable burritos, bowls, salads, and tacos. The company’s financial performance and valuation are key factors for investors considering an investment in Chipotle. To understand Chipotle’s financial health and its potential for future growth, we delve into its recent financial statements, key metrics, valuation, and risk-reward profile.

Financial Statement Analysis

Chipotle’s financial statements provide insights into its operational efficiency, profitability, and financial position.

Income Statement Analysis

Chipotle’s income statement reveals its revenue growth, cost structure, and profitability. In recent years, Chipotle has consistently demonstrated strong revenue growth, driven by its expanding store base and increasing customer demand.

- Revenue Growth: Chipotle’s revenue has grown significantly in recent years, indicating strong customer demand and successful expansion strategies. In 2022, the company’s revenue grew by 13.5% compared to the previous year.

- Profitability: Chipotle’s profitability is measured by metrics like gross profit margin and operating margin. Its high gross profit margin reflects its efficient food sourcing and cost management, while its operating margin demonstrates its ability to control expenses and generate profit. In 2022, Chipotle’s gross profit margin was 72.9%, and its operating margin was 21.8%.

Balance Sheet Analysis

Chipotle’s balance sheet provides insights into its assets, liabilities, and equity.

- Assets: Chipotle’s assets include its restaurants, equipment, inventory, and cash. The company’s significant investment in its restaurant network is a key driver of its revenue growth. In 2022, Chipotle’s total assets amounted to $8.2 billion.

- Liabilities: Chipotle’s liabilities include its debt obligations and other financial commitments. The company’s debt levels are relatively low, indicating a strong financial position. In 2022, Chipotle’s total debt was $1.3 billion.

- Equity: Chipotle’s equity represents the ownership stake in the company. The company’s strong financial performance has led to a significant increase in its equity over the years. In 2022, Chipotle’s total equity was $6.9 billion.

Cash Flow Statement Analysis

Chipotle’s cash flow statement reveals its cash inflows and outflows from its operating, investing, and financing activities.

- Operating Cash Flow: Chipotle’s strong operating cash flow reflects its ability to generate cash from its core business operations. In 2022, Chipotle’s operating cash flow was $2.4 billion.

- Investing Cash Flow: Chipotle’s investing cash flow reflects its investments in its restaurant network, equipment, and other assets. In 2022, Chipotle’s investing cash flow was -$1.4 billion, primarily due to its restaurant expansion.

- Financing Cash Flow: Chipotle’s financing cash flow reflects its activities related to debt financing and equity issuance. In 2022, Chipotle’s financing cash flow was -$1.0 billion, primarily due to share repurchases.

Key Financial Metrics

Chipotle’s financial performance can be further analyzed using key metrics that provide a deeper understanding of its growth, profitability, and efficiency.

- Return on Equity (ROE): ROE measures a company’s profitability relative to its equity. A higher ROE indicates that a company is generating a greater return on its shareholders’ investment. In 2022, Chipotle’s ROE was 35.1%, demonstrating its strong profitability and efficient use of equity.

- Return on Assets (ROA): ROA measures a company’s profitability relative to its assets. A higher ROA indicates that a company is generating a greater return on its assets. In 2022, Chipotle’s ROA was 16.2%, indicating its efficient use of assets to generate profits.

- Debt-to-Equity Ratio: The debt-to-equity ratio measures a company’s leverage. A lower ratio indicates a lower level of debt relative to equity. In 2022, Chipotle’s debt-to-equity ratio was 0.19, indicating a conservative debt structure and a strong financial position.

Valuation Analysis

Chipotle’s valuation reflects investor sentiment and expectations about its future growth prospects.

Price-to-Earnings Ratio (P/E Ratio)

The P/E ratio measures a company’s stock price relative to its earnings per share. A higher P/E ratio indicates that investors are willing to pay a higher price for each dollar of earnings. As of February 2023, Chipotle’s P/E ratio was 42.7, indicating a premium valuation compared to the broader market. This premium valuation reflects investor confidence in Chipotle’s growth potential and its strong brand recognition.

Price-to-Sales Ratio (P/S Ratio)

The P/S ratio measures a company’s stock price relative to its revenue per share. A higher P/S ratio indicates that investors are willing to pay a higher price for each dollar of revenue. As of February 2023, Chipotle’s P/S ratio was 4.4, indicating a premium valuation compared to its peers in the fast-casual restaurant industry. This premium valuation reflects investor confidence in Chipotle’s brand strength and its ability to maintain strong revenue growth.

Comparison to Peers and Historical Valuations

To understand Chipotle’s valuation in context, it’s essential to compare its metrics to those of its peers and to its historical valuations.

- Peer Comparison: Chipotle’s P/E ratio and P/S ratio are higher than those of its peers in the fast-casual restaurant industry, such as McDonald’s (MCD) and Yum! Brands (YUM). This premium valuation reflects investor confidence in Chipotle’s brand strength, its ability to maintain strong revenue growth, and its commitment to food quality and sustainability.

- Historical Valuation: Chipotle’s valuation has fluctuated over time, reflecting changes in investor sentiment and economic conditions. However, the company’s valuation has generally remained above its historical averages, indicating a consistent premium valuation. This premium valuation reflects investor confidence in Chipotle’s long-term growth prospects and its strong brand recognition.

Risk and Reward Profile

Chipotle’s investment profile presents both risks and rewards for investors.

- Risks:

- Competition: Chipotle faces intense competition from other fast-casual restaurants, as well as from traditional fast-food chains that are expanding into the fast-casual space.

- Food Safety Concerns: Chipotle has experienced food safety issues in the past, which have negatively impacted its reputation and sales.

- Labor Costs: Chipotle’s labor costs are significant, and rising wages could put pressure on its profitability.

- Economic Downturn: A decline in consumer spending could negatively impact Chipotle’s sales.

- Rewards:

- Growth Potential: Chipotle has a significant growth potential, both domestically and internationally. The company is expanding its store base and exploring new menu items to attract a wider customer base.

- Strong Brand: Chipotle has a strong brand reputation for its high-quality ingredients, customizable menu, and focus on sustainability. This strong brand equity helps to drive customer loyalty and revenue growth.

- Innovation: Chipotle is constantly innovating to improve its customer experience and stay ahead of the competition. The company is investing in technology to streamline its operations and enhance its digital ordering and delivery capabilities.

Chipotle stock has been on a rollercoaster ride lately, with investors trying to figure out the impact of inflation and labor costs. It’s interesting to see how other food giants are navigating these challenges, like the ceo of starbucks , who’s had to deal with similar pressures.

Ultimately, Chipotle’s success will depend on its ability to manage these challenges and keep its loyal customers coming back for more.

Chipotle stock has been on a bit of a roller coaster ride lately, but their focus on fresh ingredients and a loyal customer base is definitely a plus. It’s interesting to compare their performance to sbux stock , which has been steadily growing despite the current economic climate.

Both companies are strong contenders in their respective sectors, but Chipotle’s ability to adapt to changing consumer tastes will be key to their long-term success.